- Home

- About us

- Services

- Quick services

Accounting services

Accounting services are an essential pillar of maintaining financial integrity

Tax services

We provide comprehensive services including registration for VAT and preparation of tax returns

Auditing services

We provide comprehensive audit services that ensure the accuracy and transparency of your company's financial statements.

Accounting and administrative programs

We provide comprehensive services including registration for VAT and preparation of tax returns

Bookkeeping Services

Our bookkeeping services provide comprehensive financial solutions that allow you to focus on growing your business

- Contact us

AR

AR

- Home

- About us

- Services

- Quick services

Accounting services

Accounting services are an essential pillar of maintaining financial integrity

Tax services

We provide comprehensive services including registration for VAT and preparation of tax returns

Auditing services

We provide comprehensive audit services that ensure the accuracy and transparency of your company's financial statements.

Accounting and administrative programs

We provide comprehensive services including registration for VAT and preparation of tax returns

Bookkeeping Services

Our bookkeeping services provide comprehensive financial solutions that allow you to focus on growing your business

- Contact us

AR

AR

About us

At Besan Financial and Tax Services Company, excellence and innovation that go beyond the ordinary are the foundation of everything we offer. For us, the top priority is the customer and his interest, which drives us to provide unique services that always put our customers first. We are committed to ensuring that our customers see the difference in every aspect of our service, assuring them that they truly deserve what is better and different from others. We have a passion for creating positive change in their business organizations, by providing innovative financial and tax solutions that exceed expectations and make a real difference, which has led to the currently attractive position of trust among a large segment of our new clients who are looking for a true financial partner that always guarantees that they are the first responder to everything that ensures the safety of their businesses. And its sustainability

Top 50 audit and tax firms

It is consistently ranked among the best tax and audit companies in the UAE.

100% customer satisfaction

Our efforts are dedicated to providing attention to all our customers.

More than 2000 feasibility studies

We are proud to have conducted more than 2,000 feasibility studies for small and large projects.

Goal

In today's world, where the pace of economic and financial changes is accelerating, our company stands as your strategic partner in facing financial and tax challenges with confidence and efficiency. We are here to guide you towards financial success and stability, backed by years of experience and a deep understanding of financial and tax laws and regulations. Our overall goal is to enable our clients to make the most of their financial resources, by providing accurate and customized financial and tax advice that suits their unique needs, from strategic financial and tax planning, to the effective implementation of plans that ensure growth and prosperity.

Our services

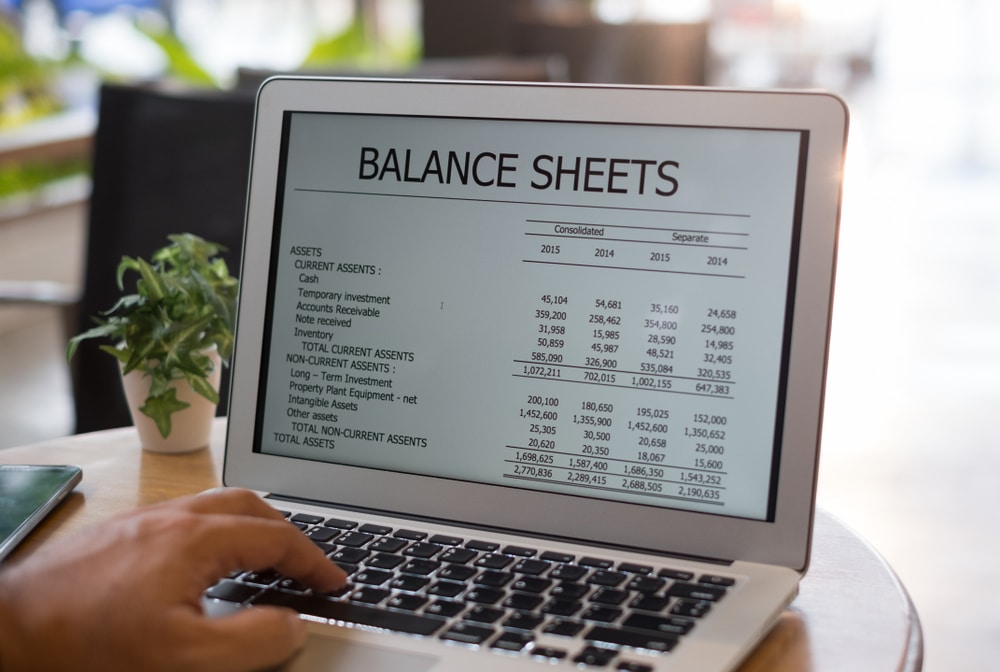

Accounting services

Accounting services are an essential pillar for maintaining financial integrity and enhancing transparency in organizations

Tax services

We provide comprehensive services that include registering for VAT and preparing and submitting tax returns on a regular basis.

Auditing services

We provide comprehensive audit services that ensure the accuracy and transparency of your company's financial statements.

Accounting and administrative programs

Besan provides a service for installing and preparing powerful and easy-to-use accounting programs to help companies produce accurate financial and administrative reports.

Frequently Asked Questions ?

why us !

What taxes must companies pay in the UAE?

In the UAE, taxes that companies must pay include value added tax (VAT) which is applied to goods and services at a rate of 5%, and corporate tax which is imposed on profits at a rate of up to 0% depending on classification and economic sector.

What tax procedures must companies follow to comply with tax legislation?

Tax procedures that companies must follow to comply with tax legislation include:

1. Register the company for value added tax (VAT) if it is eligible for registration.

2. Periodic reporting on operations covered by the tax.

3. Updating accounting and financial records accurately and regularly.

4. Maintain invoices and documents supporting tax transactions.

5. Pay the taxes due on the specified dates.

6. Cooperate with the tax authorities and provide the required information upon request.

7. Consult regularly with tax professionals to ensure full compliance and avoid tax risks.

What services can the audit office provide to organizations to enhance tax compliance?

– Assess current compliance and guide companies to improve it.

– Review accounting records to ensure compliance with tax legislation.

– Providing advice on effective and legal tax structures.

– Training employees on tax rules and tax procedures.

How can the Accounting and Auditing Office help companies manage financial and tax reports?

– Providing audit services to ensure the accuracy and reliability of financial reports.

– Analyze financial reports and provide advice on future improvements and enhancements.

– Providing tax consultations to achieve compliance with tax legislation and reduce tax risks.

– Develop and implement tax management strategies and provide guidance on tax compliance.

What are the new tax laws and legislation that companies must consider?

- Consulting with local tax professionals to develop effective and appropriate tax strategies.

- Use available tax incentives and exemptions in line with tax laws.

- Analyze company tax structures to identify opportunities to reduce tax.

- Implement appropriate financial technology to streamline tax processes and improve compliance.

- Commitment to full compliance with tax legislation and accurate and timely reporting.

- Periodic review of tax policies and procedures to ensure their compliance with current legislation.

- Stay away from illegal or unethical tax practices.

Customer reviews

Bisan Office is one of the best accounting, auditing and tax offices in the Emirates

Besan Financial and Tax Services: Excellence and innovation that go beyond the ordinary are the foundation of everything we offer. For us, the top priority is the customer and his interest

Our services

Accounting services

Tax services

Auditing services

Accounting and administrative programs